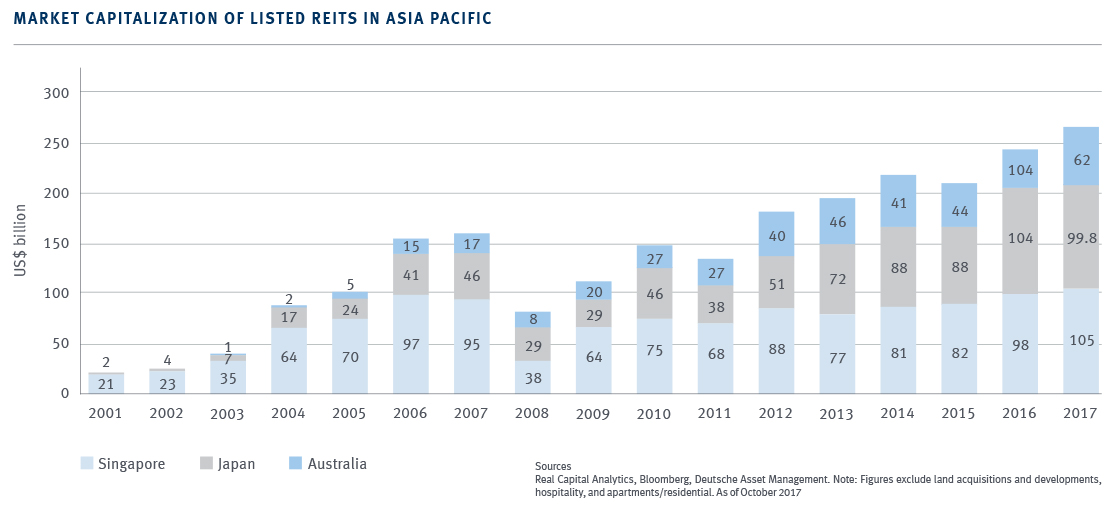

Singapore is emerging as a listing destination for Real Estate Investment Trusts (REITs). With market capitalization of USD 62 billion – behind Australia and Japan – Singapore’s REIT market has experienced steady growth over the last 15 years.1 The first Singapore REIT was listed in 2002 and the current total stands at 32.

Like equities, REITs offer investors potential long-term capital appreciation, but REITs also have bond-like characteristics, namely, the provision of regular income streams derived from rental cash flows, making REITs particularly appealing to retirees.2 Institutional and individual investor flows into Singapore REITs (S-REITs) are continuing to rise as this asset class has outperformed domestic government bonds, fixed deposits as well as traditional private equity real estate. In addition, during the past five years the 20 largest REITs listed on the Singapore Exchange delivered a return close to 11.1 percent while the Straits Times Index delivered 5.6 percent.3

While S-REITs have taken advantage of Singapore’s deep property market, those that have overseas exposure are particularly appealing to Asian investors who are looking to reduce concentration risk.4 On the diversification front, some fund managers believe S-REITs will benefit from potential interest rate increases, yet they have also performed strongly during more unfavourable market conditions.5 Investors frustrated by subpar yields on fixed income and concerns that the decade-long equity bull-run may lose steam are turning their attention to S-REITs.

Singapore: A robust REITs market

Singapore is expected to continue to expand as the dominant regional listing hub, buoyed by foreign and local issuer interest and prudent government policies.11Growth is being supported by the Singaporean government, which is encouraging investment trust flotations in order to help raise funds for the ambitious infrastructure projects that form the centrepiece of China’s Silk Road Initiative.12

A strong regulatory and legal infrastructure with clearly defined investment guidelines has helped reinforce Singapore's standing as a robust REIT jurisdiction.13 “The tax regime was also crafted to confer attractive tax concessions to S-REITs in terms of flow-through treatment for certain classes of income, exemption of specified foreign income and stamp duty remission on property transfers," according to a PricewaterhouseCoopers (PwC) report.14

The same PwC report added that tax transparency treatment on taxable income is also available to REIT unitholders.15 All of these advantages are underpinned by a deep pool of service provider talent and experience. The expertise in Singapore is evident by the innovation currently underway in REITs, as a number of firms are diversifying across property classes, including shifts into dormitories for foreign workers and students, healthcare centres, retirement homes, and data centres.16

No room for complacency

While Singapore remains an industry leader in Southeast Asia for REITs, its neighbours may be closing the gap. Hong Kong, a city with an active real estate sector, is looking to create a more robust REITs framework and increase its 10 percent regional market share.17 Other Southeast Asian markets are also attempting to solidify their positions as REIT hubs, with IPOs in Thailand and Malaysia amassing USD 2.5 billion and USD 154.9 million, respectively.18

Countries are increasingly strengthening their REIT regimes as they recognize that the asset class provides significant commercial opportunities and diversification benefits

- Doug Moore, Head, Investor & Treasury Services, Asia Pacific

In addition, PwC notes that the Singaporean REITs market is fairly saturated and predicts there may be consolidation in the sector over the next 12 months, with providers being acquired by larger players or cash-heavy corporate rivals.19 Nonetheless, PwC stated that “with significant new supply in the pipeline across several asset classes (especially retail), headwinds for REITs are likely to continue, notwithstanding a recent firming of rents in the office sector.”20

Singapore's regional dominance in the REIT market may not be impregnable, as a number of countries are looking to challenge its current dominance. “Singapore is one of the leading REIT hubs in Asia-Pacific, but competition has been emerging for several years now. Countries are increasingly strengthening their REIT regimes as they recognize that the asset class provides significant commercial opportunities and diversification benefits," explained Doug Moore, Head, Investor & Treasury Services, Asia Pacific.

Key insights

- REITs are an attractive investment proposition for investors looking for stable returns and diversification

- Singapore has successfully capitalized on that demand through its S-REIT structure

- Singapore's REIT market is expected to continue to grow, supported by a favourable macro environment and regulatory regime, as evidenced by the expansion of providers into more diverse property classes

- Regional competition is starting to emerge in Hong Kong, Thailand, and Malaysia, which could increase competition in Southeast Asia's REIT market

You may also like

Sources

- PricewaterhouseCoopers (November 2017) Emerging Trends in Real Estate: Asia-Pacific 2018

- The Straits Times (October 1, 2017) The ABCs of REITs

- Dollars and Sense (November 1, 2017) S-REIT Report Card: Here’s How REITs In Singapore Performed In Third Quarter Of 2017

- Today (January 30, 2017) Opportunities amid challenges in S-REIT sector

- The Straits Times (October 1, 2017) The ABCs of REITs

- Business Times (April 25, 2017) Will REITs continue to return 10% a year?

- Reuters (November 30, 2017) Cromwell European REITs listing marks strong year for Singapore IPOs

- The Straits Times (November 23, 2017) Singapore's neighbours are catching up in IPO leaderboard

- Schroders (April 10, 2017) Singapore REITs: Do they still possess long-term value?

- Ibid

- The Straits Times (October 1, 2017) The ABCs of REITs

- Nikkei Asian Review (October 21, 2017) How Singapore sees itself complementing China's Belt and Road

- PricewaterhouseCoopers (July 2017) Compare and Contrast: Worldwide Real Estate Investment Trust (REIT) Regimes

- Ibid.

- Ibid.

- Today (January 30, 2017) Opportunities amid challenges in S-REIT sector

- ejinsight (November 6, 2017) How Hong Kong REITs can boost their growth

- The Strait Times (November 23, 2017) Singapore's neighbours are catching up in IPO leaderboard

- PricewaterhouseCoopers – Emerging Trends in Real Estate: Asia-Pacific 2018

- Ibid.