Canadian defined benefit pension plans continue to embrace alternative investments as they look for opportunities to enhance the ongoing sustainability of their plans during today’s unprecedented times.

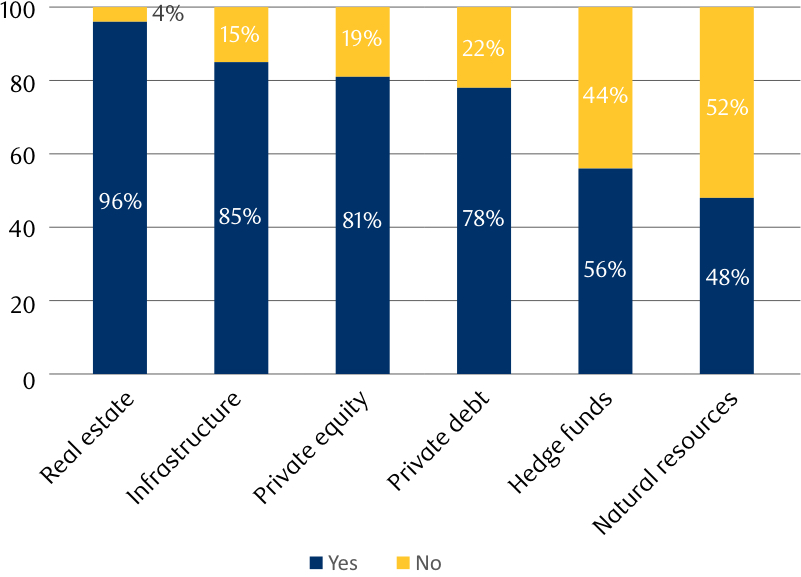

Insights from RBC Investor & Treasury Services’ fourth annual Canadian Defined Benefit Pension Survey, conducted in November of 2020, reveal that nearly three-quarters (73%) of the 122 pension plan respondents currently hold alternatives within their plans or expect to add them in the near term. This increased to 96% of large plans with assets of more than $5 billion and 94% of private-public plans. According to the survey, real estate and infrastructure are the most popular alternative investments, held by 96% and 85% of pension plan respondents respectively (see Figure A). 1

Figure A

Proportion of Pension Plans Holding Alternative Investments By Asset Class1

Nearly three-quarters of Canadian defined benefit pension plans currently hold alternative investments within their plans.

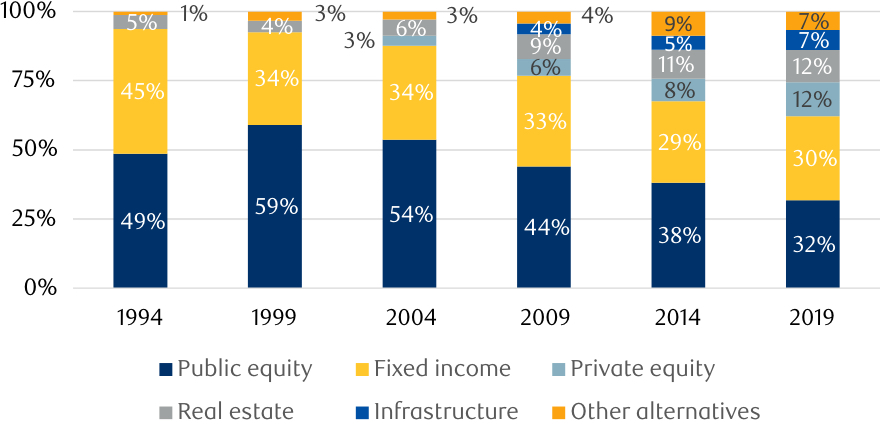

Allocations to alternatives have increased significantly over the past 15 years. Asset mix data from the Pension Investment Association of Canada indicates that defined benefit pension plan allocations to alternative investments have more than tripled from 12% of assets in 2004 to 38% in 2019 (see Figure B).2 Furthermore, Canadian pension plans are adopting alternatives at a much higher rate than their counterparts in other parts of the world. Consultant Willis Towers Watson estimates that pension plans in Canada currently allocate 32% of their portfolios to private assets, including real estate, private equity and infrastructure. This compares to 26% for the top seven pension markets in the world.3

Canadian defined benefit pension plan allocations to alternative investments have more than tripled over the past 15 years.

Figure B

Canadian Defined Benefit Pension Plans Asset Mix2

The RBC Investor & Treasury Services survey points to a continuation of the alternative investment trend as pensions signal their intention to re-assess asset management strategies and adjust the asset mix of their plans in response to COVID-19. The survey also showed that “use of alternatives” has emerged as a popular de-risking tool, close behind “liability-driven investments.”

What’s driving the move to alternatives?

Pensions are concerned about the ongoing sustainability of their plans. The survey indicated that over 80% of respondents are considering approaches to enhance future plan sustainability. This “rethink” is occurring at a time of declining confidence in pension plans’ ability to meet ongoing liabilities in the face of persistently low interest rates, an uncertain geopolitical environment and volatile financial markets—the three top challenges highlighted by respondents.

The move to alternatives coincides with concerns about the ongoing sustainability of pension plans.

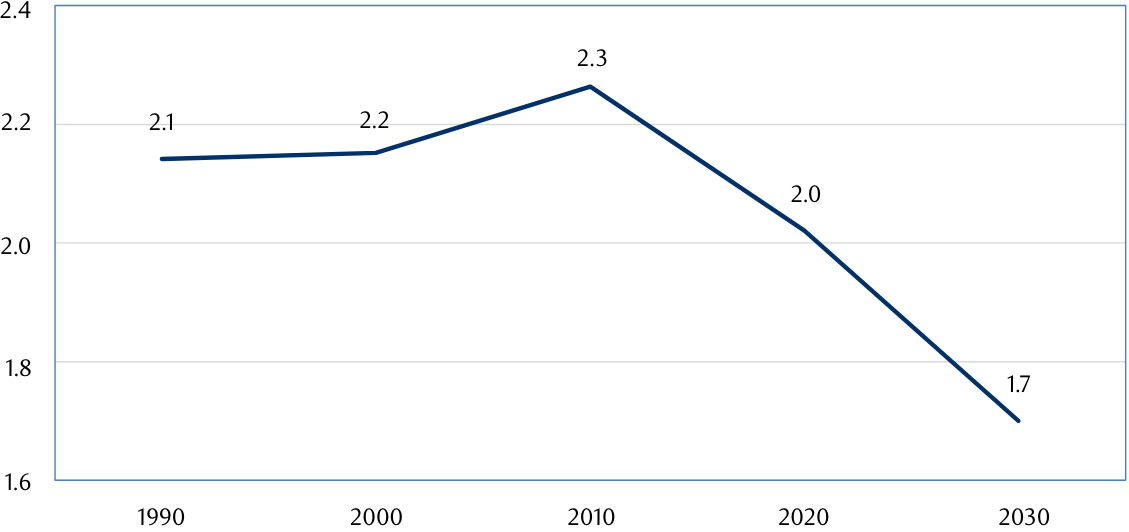

In addition to uncertainty about the economy and increasing political turmoil, Canada’s aging population is set to inflict increased pressure on the pension sector. RBC Economics forecasts that the share of Canada’s senior population will increase from 17% in 2018 to approximately 22% in 2030—triple what we saw from 2000 to 2009 and nearly quadruple that experienced in the 1990s. In addition, the number of working-age Canadians for every youth and senior is expected to decline from 2.3 in 2010 to 1.7 in 2030 (see Figure C).4 Strong interest in alternatives has emerged as a favoured approach to offset the impact of these demographic trends.

Figure C

Working-Age Canadians for Every Youth and Senior4

The easing of pension funding rules in certain provinces has provided the opportunity for plans to supplement their portfolios with potentially riskier and higher-return investments such as alternatives to help meet increasing obligations from an aging workforce. The new rules strengthen the lower going-concern (ongoing operations) funding requirement and reduce the higher solvency (immediate termination) obligation. While other provinces have generally maintained both funding requirements, some have smoothed contributions over longer periods.

The easing of pension funding rules has contributed to the rising popularity of alternatives.

The popularity of alternative investments among Canadian defined benefit pension plans seems likely to continue its upward trajectory as pensions seek additional returns in today’s uncertain times. In commenting on the RBC Investor & Treasury Services pension survey results, Serge Lapierre, Head of Liability-Driven Investments at Manulife Investment Management, provides a cautionary note on the increasing use of alternatives as a de-risking tool: “It is important to find the right balance between earning higher returns and managing your liability risks.”1

It is important to take a holistic view in using alternative investments to manage risk.

To view the full RBC Investor & Treasury Services Canadian Defined Benefit Pension Survey 2021 report, entitled Pathways to Sustainability, please click here.