Although the roadblocks to change vary depending on where pension plans are located, executing on transformation will define the agenda for asset owners across the globe, according to a recent survey.

Ryan Silva, Head of Pensions & Insurance, Client Experience, at RBC Investor & Treasury Services, and Barnaby Nelson, CEO of research firm The ValueExchange, dig into the results of the 2021 Asset Owner Transformation Survey* to share top insights on the path to transformation for pension plans in Canada and abroad.

1. Asset owners tend to “think local, not global” when responding to change

The pressures and challenges facing pension plans around the world vary by region, The ValueExchange survey finds.

In Australia, regulatory pressures dominate, with “a high degree of regulatory enforcement," comments Nelson, as regulators seek to make markets aware that plans are meeting regulator-imposed requirements.

Pressures and challenges facing pension plans around the world vary by region

Across Europe, in contrast, plans are focused on environmental, social and governance (ESG) targets, with a particular emphasis on restructuring organizations to accommodate more transparent governance architecture and to meet diversity, equity and inclusion goals.

Looking at North America, the forces driving change are more diffuse, says Nelson, with pressures around operational efficiency and managing operational risk topping the list: “Canadian and US plans face internal drivers of change, versus external pressures," he adds.

The upshot of these regional differences is that plans may “think locally, not globally" when matching their responses to the drivers of change.

2. The right staff structure often leads pension plans to the right tech model

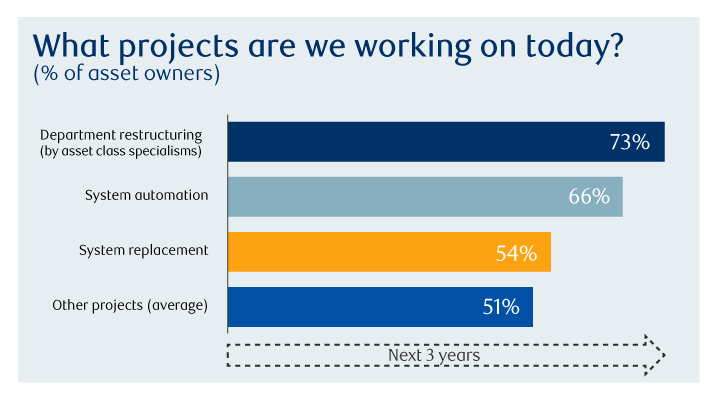

Org-chart transformation is also a focus for asset owners and, for many, it may precede tech transformation.

The current low-interest-rate environment has pension plans on a search for yield in emerging markets, including Asia and Africa, and Canada is at the head of that trend. This search also has plans exploring new asset classes and, in particular, moving away from public equities markets into private debt and private equity.

The move to new asset classes often leads to org-chart transformation, which in turn can lead to tech transformation. “If you get the staff structure right, this generally leads to the right technical model as the next step," says Nelson. Today, asset owners are developing vertical structures around the new asset classes to meet “front-to-back operating needs."

3. Asset owners are turning to software vendors as change partners

Across the globe, the survey found that the pace of tech adoption has increased as the take-up of new tech spurs product innovation and rethinking what's possible.

Today's asset owners have a range of mechanisms to leverage technology, with larger plans putting more direct effort into investment governance and smaller plans focusing on expanding the scope of their investments.

Today's asset owners have a range of mechanisms to leverage technology

For plans of all sizes, technology is getting “more and more intertwined" into the management of asset classes, comments Silva, meaning that asset owners of all sizes can use tech to better manage risk, and to locate and deliver on operational efficiencies. Not surprisingly, some 40% of asset owners say they're turning to software vendors as their partners in change, according to the survey findings.

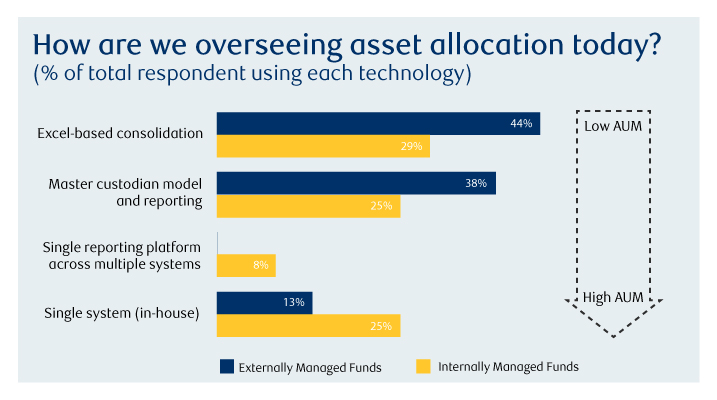

4. Smaller pensions are still using Excel for asset allocation

The survey also uncovered continuing operational reliance on Excel, finding that globally, 44% of asset owners are using Excel to manage asset allocations. This finding generally corresponds to plan size: While larger plans can develop and implement sophisticated asset management systems, smaller plans simply don't have the scale.

What options, then, do smaller plans have in the face of rapid tech transformation? There are two main paths, according to Silva. The first is for smaller plans to leverage the strengths of their key partners—investment consultants, custodians and investment managers—to “buy into their scale." It's the core business of these partners, such as master custodians, to be able to manage complexity at all levels.

A second alternative is plan consolidation, and here Canada leads the way with examples such as the Colleges of Applied Arts and Technology (CAAT) pension plan's DBplus option, adds Silva.

Please contact Ryan Silva at RBC Investor & Treasury Service for more information.

*The 2021 Asset Owner Transformation Survey—conducted by research firm The ValueExchange in September/October 2021 with the support of RBC, Milestone Group, Citisoft and Adapa Advisory—includes the insights of 130 asset owners and their service providers from around the world.