More than 30 years ago, the European Union created a cross-border fund system with a broad range of asset classes and global reach. Today, Undertakings for Collective Investment in Transferable Securities (UCITS) are typically domiciled in Ireland and Luxembourg, and sold in more than 90 different marketplaces around the world, from Europe and Latin America to Asia-Pacific and North America.

In the face of heightened regulation, market volatility, intense competition and earnings pressure, UCITS represents an opportunity for Canadian investment managers to expand their distribution networks globally and support business growth.

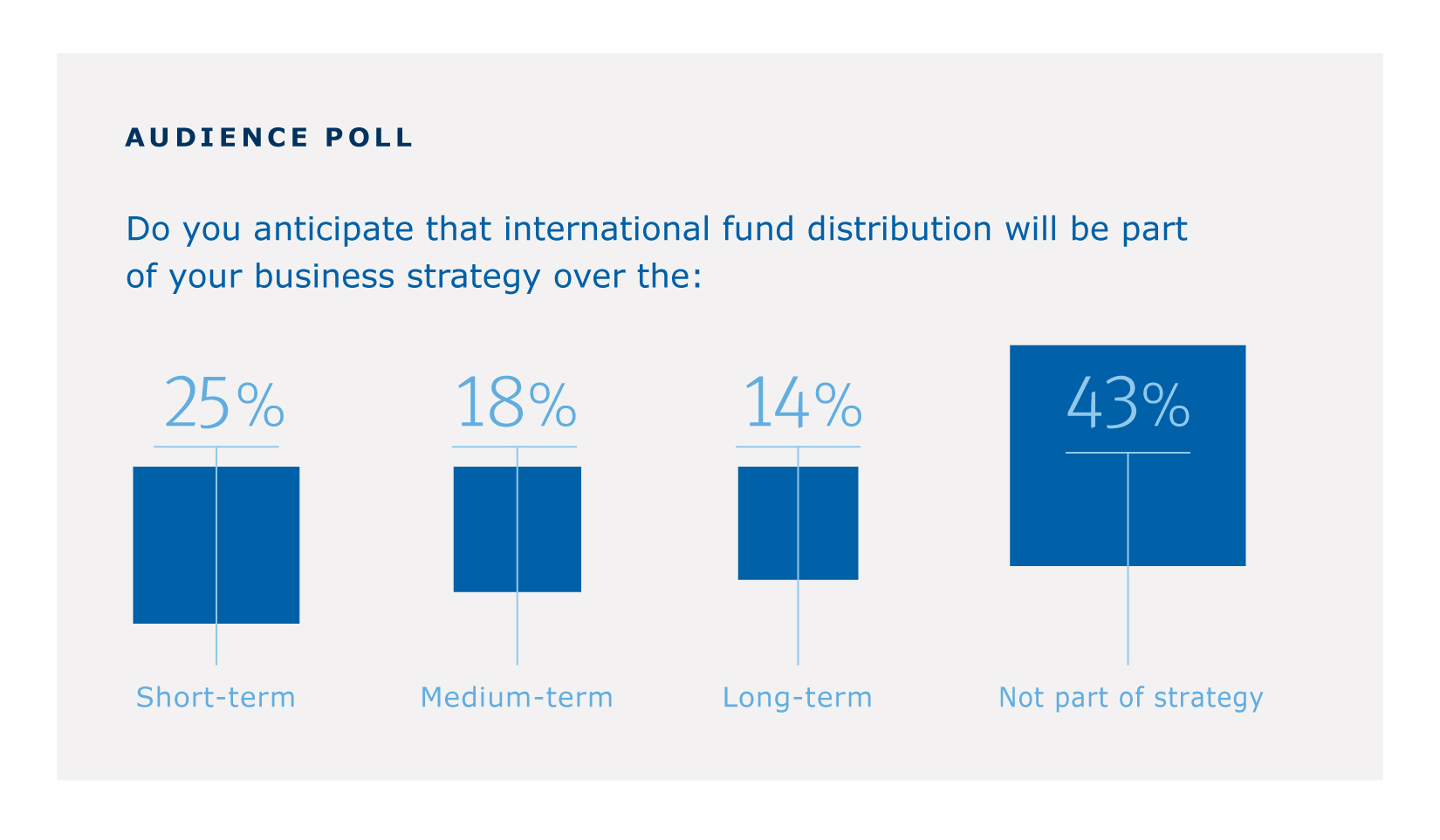

At RBC Investor & Treasury Services’ 2016 Investor Forum, held recently in Toronto, the majority of participants indicated that UCITS and international fund distribution are not yet part of their strategies.

Is this a missed opportunity? A panel of US-based asset managers, who have successfully employed UCITS to enter new markets and drive business growth, shared their experiences:

- Build a UCITS strategy into your five-year business development plan and ensure that management is on board. There are many stories of great products and brands that fail to succeed because they don’t fit into the firm’s overall objectives. Alignment and patience are key.

- Focus. Understand specific market needs and the value that your firm can deliver. Target key regions and accounts where your value proposition will resonate.

- Consider local distribution before entering global markets. Take the opportunity to gain the necessary scale before expanding into non-home country markets. Panellists suggested raising at least CAD 100 million locally before approaching global fund buyers.

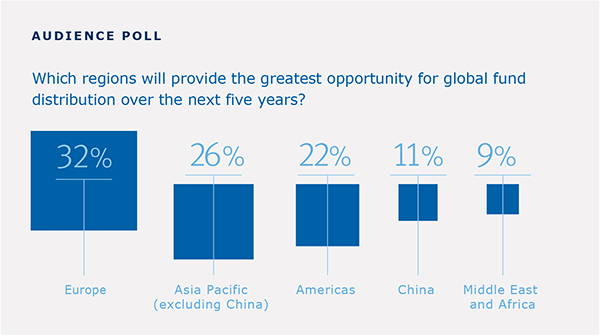

- Panellists also recommended Europe, the birthplace of UCITS, as the first foreign market to explore. However, there are challenges. As one panellist said: “This is a long-term dance. There will be meetings where you never do anything but talk about the weather or economics. It’s about relationship building and exceptional service, and that requires resources. When you’ve earned trust, you become an evolving partner but that takes time. Money in Europe is very sticky when it believes in you.”

- The European investment management landscape is tactical by nature and details are critical. To this end, tailor your research accordingly and be clear about what differentiates your firm when meeting with fund buyers.