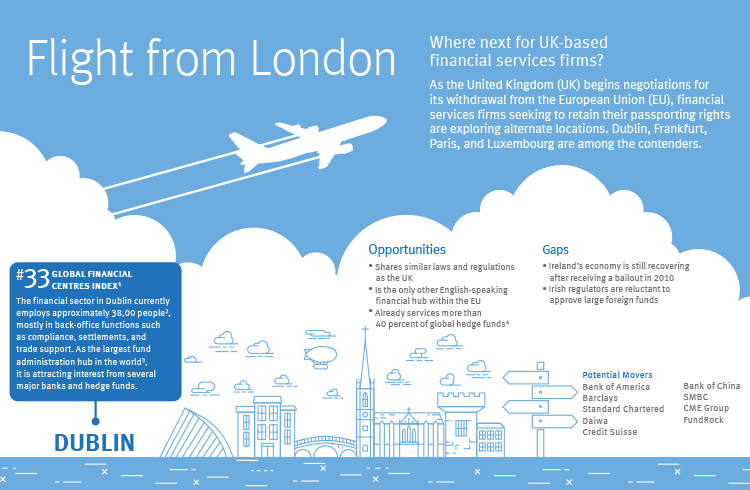

This edition of RBC Investor & Treasury Services' Flight from London series examines the potential for Dublin to attract UK-based financial service firms post-Brexit.

Within two years, Ireland will become the only market within the European Union (EU) with English as its home language, a common law system and unfettered access to the Single Market and EU-based talent. As the UK negotiates its departure from the EU, Dublin is preparing for a potential influx of international finance companies.

Dublin is already home to a number of large financial firms, as well as tech giants such as Google and Facebook. Should London-based firms lose their passporting rights, asset managers could be attracted to Dublin as they seek alternate routes of access to EU markets.

Key insights

- As the only English-speaking market within the EU that has a common law system, access to the Single Market, and access to EU-based talent, Dublin is preparing for an influx of international finance companies as the UK negotiates its departure from the EU

- Ireland's EUR 2.1 trillion of domiciled funds elevates the country's position as a destination for financial services firms seeking access to EU markets

Ireland boasts a fund market with total assets under administration of EUR 4.1 trillion; EUR 2.1 trillion are Irish-domiciled, and EUR 2.0 trillion are non-domiciled managed across 13,785 funds (6,470 and 7,315 respectively).1

Additionally, Ireland is the largest hedge fund administration centre in the world, and more than 40 percent of global hedge funds are serviced in Ireland.2

With such a significant market already in place, many banks, insurers and asset managers have shortlisted Dublin as a possible relocation hub.

Planning for the future

Ireland has received more than 70 information requests from UK-based firms looking to relocate.3 The increased interest in Dublin as a financial services centre has spurred the Central Bank of Ireland (CBI) to increase its staff by more than a quarter to ensure that Brexit-related issues can be effectively managed.4 Regulators and bankers in Dublin do not expect that financial firms will leave London en masse, but they are expecting to attract segments of their EU-facing business.

The increased interest in Dublin as a financial services centre has spurred the Central Bank of Ireland (CBI) to increase its staff

In order for London-based financial firms to relocate to Dublin, the CBI will require them to establish a 'substantial' presence in the country, including people and infrastructure. The CBI had said it will implement a structured, robust and risk-based process that ensures that only those firms compliant with EU and Irish requirements will be authorized to establish a presence in Ireland.5

Room for growth

The CBI is not alone in anticipating an influx of London-based firms. Over the next two years, Irish real estate companies are committed to constructing 4.5 million square feet of additional office space, and plan a further five million square feet of accommodation in the Greater Dublin area.6

Dublin's finance sector could grow by as much as 50 percent over the next five years

Currently, Ireland's financial sector employs more than 38,000 people, mostly in back- office functions such as compliance, settlements, and trade support.7 As part of its action plan, IFS Ireland, a trade body for Ireland's international financial services industry, is aiming to introduce 10,000 more workers by 2020.8

Ireland is poised for growth. Should the market attract a portion of the estimated 83,000 London-based jobs expected to be transferred to an EU location,9 Dublin's finance sector could grow by as much as 50 percent over the next five years.

A game of taxes

For over three decades, Ireland's favourable tax regime has been a key incentive for foreign firms to establish headquarters in Dublin. At 12.5 percent, Ireland has one of the lowest corporate tax rates in Europe with an effective zero tax rate for foreign dividends.10

Ireland is, however, conscious that once the UK leaves the EU, the UK could become the equivalent of Singapore and compete with Ireland for foreign investment with lower taxation.

In November 2016, British Prime Minister Theresa May declared her intentions to cut UK corporation tax to be the lowest of the G20 economies following Brexit. Speaking to the Confederation of British Industry, May said her aim was “not solely for the UK to have the lowest corporate tax rate in the G20 but also a tax system that is profoundly pro-innovation".11

Relocating the European Banking Authority

If Dublin is chosen as the new home for the EBA, Ireland's financial ambitions will enjoy a major boost

As part of the UK's withdrawal from the EU, the European Council has declared that the European Banking Authority (EBA) will need to be relocated from London. Many cities across Europe have already expressed interest in hosting the EBA, with Luxembourg and Dublin the likely frontrunners.

Addressing Ireland's bid to host the EBA, Ireland's Minister of State for Financial Services Eoghan Murphy, said: “It is our aim to be seen as a global location for financial services, and securing the EBA would be a significant boost in us achieving that."12 If Dublin is chosen as the new home for the EBA, Ireland's financial ambitions will enjoy a major boost.

Possible reluctance

Despite enthusiasm from Irish officials for firms to relocate from London, commentators note there may be some reluctance to host large foreign trading operations in Dublin.13 The 2008 banking crisis, which in Ireland led to a property market decline and a GBP 71 billion international bailout, serves as a cautionary reminder to the Irish financial services sector.14

As competition for London-based financial firms heats up, Dublin is attempting to move beyond previous market turbulence and plan for the future. While Luxembourg, Frankfurt and Paris are each launching their own bids to replace London as Europe's financial capital, Irish bankers, regulators and property developers are astutely aware that Brexit is an opportunity that cannot be missed.

Next in the Flight from London series: Frankfurt

Sources

- Irish Funds (January 2017) – Fact Sheet January 2017

- PwC (October 19, 2016) Ireland - the ideal location for your funds in 2016

- Politico (February 8, 2017), Dublin gets more realistic about Brexit bonanza

- Financial Times (November 27, 2016), Ireland's central bank boosts staff for Brexit insurers

- Central Bank of Ireland (December 23, 2016), Responding to the post-Brexit environment, Director of Policy & Risk Gerry Cross

- IFS Ireland (January 16, 2017), IFS 2020: A strategy for Ireland's International Financial Services Sector 2015-2020 Action Plan2017

- IFS Ireland (2015), Ireland Grows Global

- Ibid. IFS 2020: A strategy for Ireland's International Financial Services Sector 2015-2020 Action Plan2017

- Financial Times (November 14, 2016), Losing euro-denominated clearing would cost London 83,000 jobs

- IDA Ireland (January 8, 2016), Tax Brochure 2016 - IDA Ireland

- Irish Times (November 21, 2016), Deal on transition period after Brexit vital for Ireland

- Irish Times (April 18, 2017), Ministers criticise UK assumption that it could retain key EU agencies after Brexit

- Reuters (November 22, 2017), Ireland reluctant to host high-risk bank trading after Brexit - sources

- Fortune (November 23, 2017), Here's Why Ireland May Not Become a Post-Brexit Financial Capital After All