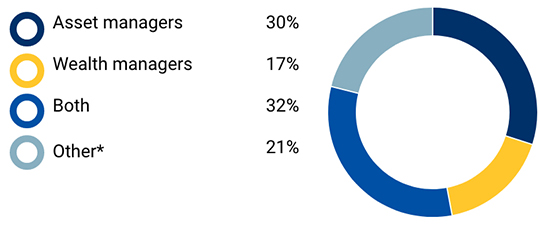

RBC Investor & Treasury Services’ annual survey of Canadian asset and wealth managers, conducted in June 2020, reflects the perspectives of 101 managers from across the country.

The Quest for Resilience

Canadian Asset and Wealth Manager Survey 2020

Key takeaways

o Respondents are maintaining a positive outlook in the face of COVID-19 and ongoing market volatility

o Managers continue to focus on building resilient organizations as they look to improve efficiency through digitization and integration across their firms—efforts that were accelerated in response to the pandemic

o Data is increasingly important but price and quality are key considerations

o Interest in socially responsible investing remains lukewarm—at least for now

o Managers anticipate increased demand for cash during these recessionary times, while an expected shift to active investments may not achieve the desired results

o Working from home will endure but on-site working is unlikely to disappear

o Underlying clients are deemed to value transparency and efficiency more than low fees and high returns—a reversal, which likely reflects the current disruptive environment

Did you know?

$8.4M

Cost of a single data breach in Canada’s financial industry(1)

44%

Proportion of US CFOs planning to accelerate automation(2)

4.6B

# of people with internet access—59% of the world’s population(3)

39%

Proportion of Canadian workers teleworking at the end of March 2020(4)

- 1 IBM Security and Ponemon Institute, Cost of a Data Breach 2019

- 2 PriceWaterhouseCoopers, Pulse Survey, June 2020

- 3 Domo, Data Never Sleeps 8.0, August 2020

- 4 Statistics Canada, Running the Economy Remotely, May 28, 2020

Survey results

Positive outlook

4.1 / 5.0

View Results

Outlook remains positive

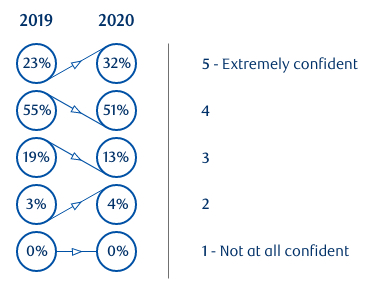

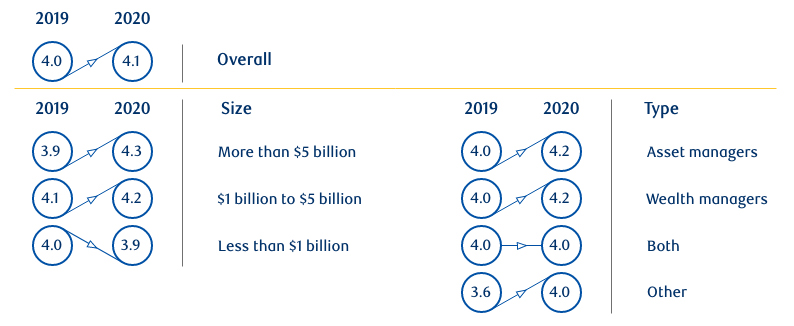

o Overall, confidence in adapting to the volatile business environment remained relatively high, increasing slightly from 4.0 to 4.1* year-over-year

o Large firms are most confident (4.3) and small managers are least confident (3.9); large firms expressed higher confidence year-over-year (3.9 to 4.3), while small managers indicated a slight decline in confidence (4.0 to 3.9)

o Asset managers and wealth managers are more confident than “other” managers (primarily in-house and third-party managers), and those with both asset and wealth management businesses (4.2 versus 4.0)

o Respondents with investment responsibilities are most confident (4.3), and those with finance and administration responsibilities are least confident (4.0)

How confident are you in your firm’s ability to adapt to the volatile business environment?

Breathing a sigh of relief

Confidence in adapting to the volatile business environment*

o Large managers

are most confident

Optimism in the midst of uncertainty

After largely weathering the initial disruption of COVID-19 in the face of ongoing market volatility, managers appear to be optimistic about their ability to continue building resilient organizations and meeting their clients’ changing needs in what hopefully becomes the post-pandemic period. Will an effective vaccine be developed? Will the economy begin to return to prepandemic levels? Will firms be able to continue to pivot, regardless of the challenges they face? The answers to these and other yet-to-be-asked questions will ultimately determine whether managers’ current level of optimism persists.

- * Based on a 5-point scale (5=extremely confident/1=not at all confident)

Lukewarm interest in SRI

3.6 / 5.0

View Results

Interest in SRI remains lukewarm

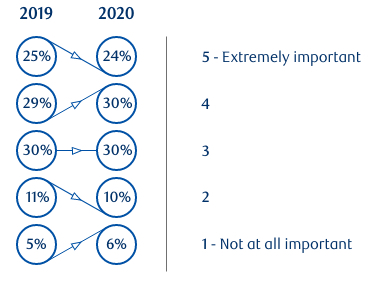

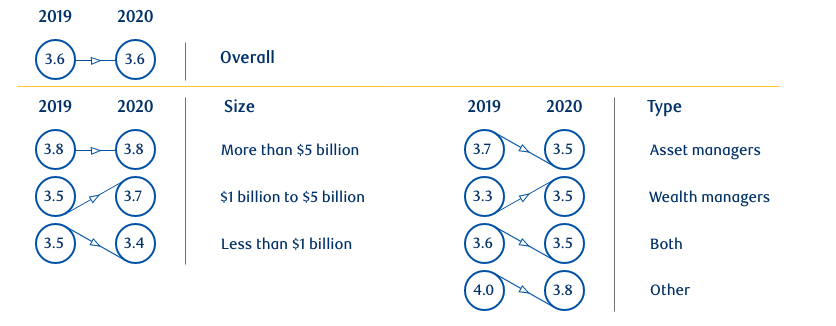

o Overall, managers rated socially responsible investing (SRI) at 3.6 (same as last year) based on a 5-point scale where 5=extremely important and 1=not at all important

o Nearly half of respondents (46%) are unenthusiastic about SRI*

o The “other” category of managers viewed SRI to be more important than the overall average (3.8 versus 3.6), while the three main manager types scored slightly below the average (3.5 versus 3.6)

o Respondents in operations roles found SRI to be most important (3.9), while those in investment roles were least enthusiastic about the strategy (3.3)

How important is SRI to your firm’s strategy?

A recent tide of social change

Importance of SRI*

o 46% of respondents

view SRI to be unimportant

o Large managers

are most interested in SRI

An opportunity to revisit investment beliefs?

While Canadian managers have indicated a somewhat underwhelming interest in SRI, albeit higher than pension plans (see below), the current focus on racial inclusion and diversity could add a sense of urgency to incorporate these factors into the creation of investment portfolios.1 In addition, sustainability and climate expertise may assume a new level of importance for certain end investors in the COVID-19 era as they take the opportunity to recalibrate their investment beliefs, potentially driving asset and wealth managers to place a stronger emphasis on these factors moving forward.2

More interested than pension plans

RBC Investor & Treasury Services’ survey of Canadian defined benefit pension plans, conducted in the latter part of 2019, reported an SRI importance rating of 3.1—well below the asset and wealth manager rating of 3.63. The difference may be a reflection of the beneficiary responsibilities of pension plans and the need to ensure that consideration of non-economic goals is compatible with their duty to maximize investment returns. It will be interesting to track whether the recent focus on racial justice and climate change affects the sentiment of pension plans toward SRI.

What is socially responsible investing?

SRI is a responsible investment strategy that screens companies from the investment universe (positive and negative screening) based on environmental, social and governance factors in order to generate measurable impact and a market rate of return.

- * Including managers with scores of 3 or lower on a 5 point scale where 5=extremely important and 1=not at all important

- 1 The New York Times, How Investors are Addressing Racial Injustice, July 3, 2020

- 2 Oliver Wyman, Asset Management: 10 Ideas for 2020, July 2020 (updated version)

- 3 RBC Investor & Treasury Services, Preparing for the Silver Tsunami, February 2020

Market volatility

#1 challenge

View Results

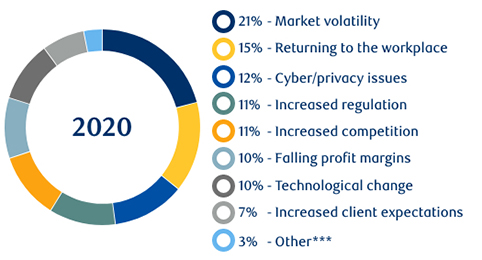

Market volatility is the #1 challenge

o “Market volatility” is deemed the top challenge facing Canadian asset and wealth managers over the next 12 months (21% of choices)—up from third place in 2019* and followed by “returning to the workplace” (new category at 15%); third-place “cyber/privacy issues” (12%) was near the bottom of last year’s concerns

o Results were generally consistent across the various respondent categories except for mid-sized** and wealth managers, who were also concerned about “technological change” (17% and 20%), and respondents with a business development role, who highlighted “increased competition” as a key issue (19%)

What are the three biggest challenges your firm faces over the next 12 months?

The COVID mindset

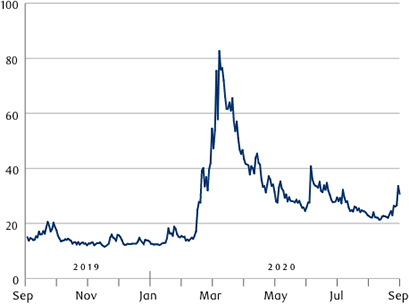

No vaccine = persistent volatility

Market volatility is top of mind among asset and wealth managers—for good reason. According to Dawn Desjardins, RBC’s Deputy Chief Economist: “The CBOE Market Volatility Index (VIX) showed a significant spike in March when uncertainty about the COVID-19 virus was at its worst. This corresponded to a very sharp decline in economic activity—so much so that, even though the Canadian and US economies were only shut down for half the month of March, it was sufficient to drive first quarter GDP into negative territory. Current volatility remains above the pre-pandemic level. I would suggest that, if there isn’t a clear line of sight on a vaccine or a way to arrest the spread of COVID-19, volatility will remain somewhat elevated.”

CBOE Market Volatility Index (VIX)

Source: Wall Street Journal / Haver Analytics

Returning to the office—slowly

After abruptly transitioning employees to their “home offices,” Canadian financial services firms are generally taking a “go-slow” approach in returning to the workplace, with many employees content to work from home—at least for the time being. Regardless of the pace, there are substantial employerrelated challenges that must be dealt with as part of the return to onsite working, ranging from ensuring employee safety to real estate implications.

Were you Zoom-bombed?

The significant impact of COVID-19 on cybercrime, including increased vulnerability of remote workplace infrastructure such as VPN and video-conferencing (aka Zoom-bombing), is reflected in some sobering metrics. During the first quarter of 2020, phishing attacks increased by 37% globally1 and COVID-related phishing email campaigns surged by 600%.2 In mid-August, the Canada Revenue Agency temporarily shut down its online services after being hit by two cyberattacks. When these attacks succeed, the financial implications are hefty. The average cost of a data breach in the Canadian financial industry is $8.4 million—$2.6 million higher than the average of $5.8 million for all other businesses, compared to the global average of $5.1 million.3

The growing cost and increased frequency of cybercrime reinforce the importance of building a cyber-resilient organization. RBC’s Chief Information Security Officer, Adam Evans, offers some guidance for organizations looking to manage cyber threats: “Cybersecurity is a business resiliency issue. It’s really important to understand what your critical assets are, build a multi-layered cyber defense plan, educate employees about potential risks, and reinforce with practice scenarios.”

Temporary regulatory relief

The lower priority of increased regulation year-over-year (falling from second place to a tie for fourth position) is likely attributed to steps taken by authorities to provide temporary relief from new and ongoing regulatory requirements in response to the pandemic. For example, the Basel Committee on Banking Supervision and the International Organization of Securities Commissions (IOSCO) recently extended the deadlines related to the final phases of margin requirements for non-centrally-cleared derivatives. The previous pace of implementing regulatory change is unlikely to return until the COVID-19 crisis stabilizes.

o $8.4M

Average cost of a data breach in the Canadian financial industry

“ I would suggest that, if there isn’t a clear line of sight on a vaccine or a way to arrest the spread of COVID-19, volatility will remain somewhat elevated."

—Dawn Desjardins, Deputy Chief Economist, RBC

“ Cybersecurity is a business resiliency issue. It’s really important to understand what your critical assets are, build a multi-layered cyber defense plan, educate employees about potential risks, and reinforce with practice scenarios."

—Adam Evans, Chief Information Security Officer, RBC

- * Year-over-year comparisons may be impacted by updates to the wording of this question in 2020 and should be considered directional

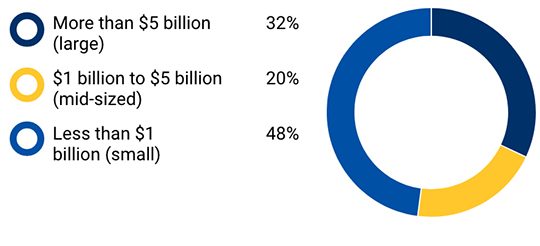

- ** Based on respondent assets under management (large=more than $5 billion; mid-sized=$1 billion to $5 billion; and small=less than $1 billion)

- *** Including lack of data to make decisions; talent management; fear of COVID-19 second wave; and access of foreign competitors to Canadian market

- 1 Tech Republic, Phishing Spotlight Research Report 2020, as reported in Lookout, June 2, 2020

- 2 KnowBe4, Q1 2020 Phishing Report, as reported in ITProPortal, April 10, 2020

- 3 IBM Security and Ponemon Institute, Cost of a Data Breach 2019

Service, transparency and efficiency

Attributes most valued by underlying clients

View Results

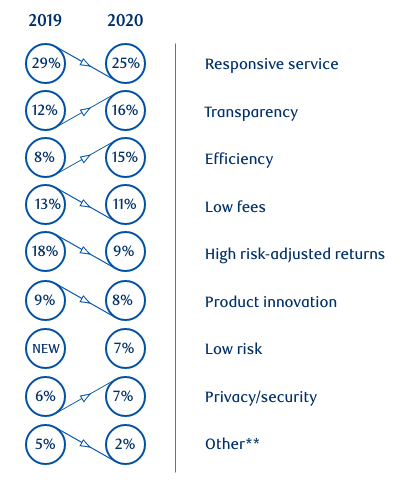

Clients value service, transparency and efficiency

o According to managers, their clients continue to deem “responsive service” as the most important factor in the clientmanager relationship regardless of size, type or role; however, this attribute is declining in importance from 37% in 2018 to 25% in 2020

o “Transparency” (16%) and “efficiency” (15%) moved up to second and third spots respectively, overtaking “low fees” (11%) and “high risk-adjusted returns,” with the latter declining significantly year-over-year (18% to 9%)

o “Product innovation” was particularly important to respondents in an operations role (15%)

What do clients value most from your firm?*

Focusing on the essentials

o 25%

of respondents deem “responsive service” to be their clients’ #1 requirement

o Transparency and efficiency

overtake low fees and high returns

Changing client priorities

It is unsurprising that managers, by a wide margin, continue to view responsive service as the most important factor in their relationship with underlying clients. However, there appears to have been a shift in manager perception of the relative importance of other factors—likely due to the impact of COVID-19. During today’s unprecedented times, client demand for high returns and low fees has been overtaken by more practical concerns around transparency and efficiency. This shift aligns with the intention of managers to focus on improving efficiency and building resilient organizations.

- * Based on respondents’ top three choices

- ** Including investment strategy; reliability; knowledge; and alternative investment options

Improving efficiency

#1 focus

View Results

Improving efficiency is the #1 focus

o Similar to last year, “improve efficiency” will be managers’ top area of focus over the next 12 months—regardless of respondent size, type or role, and with a greater proportion of choices compared to 2019 (17% to 29%)*

o Although significantly lower than the top priority, “enhance distribution channels” also experienced higher year-over-year popularity (9% to 14%) in a tie for second place with new category “update human resources policies”

o “Use data analytics” moved up the popularity list from seventh to fourth spot (6% to 11%), a strategy that is particularly important to respondents in operations roles (15%)

What are your firm’s top three areas of focus over the next 12 months?

Building a lean organization

When the going gets tough

The significant year-over-year increase in popularity of “improve efficiency” and the extent to which this priority has pulled ahead of other focus areas (29% compared to 14% for the next-highest priority) indicate that managers are clearly focused on building lean organizations with the resiliency to withstand ongoing turbulence.

Optimizing distribution

Managers are also looking for opportunities to enhance their distribution channels as social distancing becomes the new norm and a younger, tech-savvy generation moves up the investor ladder. The use of data analytics is viewed as an increasingly important decision-making tool to assist managers in optimizing their distribution models and being able to:

- Target the right clients via the right channels

- Expand wallet share with existing clients

- Develop meaningful client insights

- Identify at-risk clients

- Enhance the effectiveness of sales and marketing activities

o 29%

of respondents chose “improve efficiency” as a top focus area

Focus on employees

With the sudden transition to at-home working, human resources teams have been busily updating their policies to accommodate homebound employees and new on-site models that will be significantly different than in pre-COVID times.

- * Year-over-year comparisons may be impacted by updates to the wording of this question in 2020 and should be considered directional

- ** Including reduction of fees; marketing; online platform; artificial intelligence; talent management; firm culture; and work-from-home approach

Cash

Most popular asset class

View Results

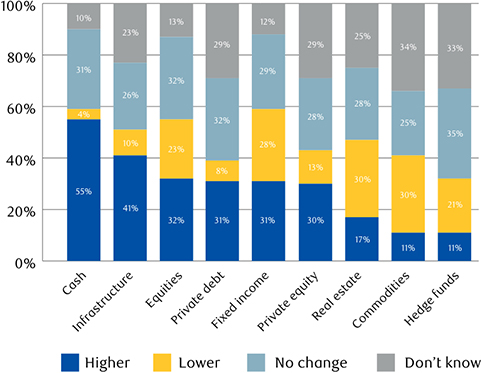

Cash is king

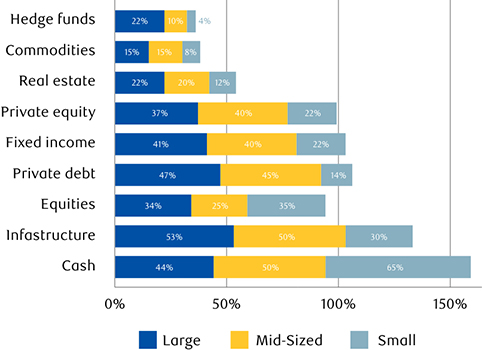

o A majority of respondents (55%) and nearly two-thirds of small managers (65%) indicated that investor demand for “cash” will increase over the next 12 months

o Approximately half of large and mid-sized managers (53% and 50%) are anticipating increased demand for infrastructure (41% overall)

o Nearly a third of all managers (30%) expect demand for “commodities” and “real estate” to decline in the near term, and a relatively high proportion of small managers (35%) expect demand for “fixed income” to decline

How do you expect investor demand for the following assets to change during the next 12 months?

The flight to safety

% of Respondents Expecting Higher Investor Demand by Size

% of Respondents Expecting Lower Investor Demand by Size

o 55%

of managers expect higher demand for cash

o 53%

of large managers forecast higher demand for infrastructure

o 30%

of respondents project lower demand for real estate and commodities

Rushing to cash in times of crisis

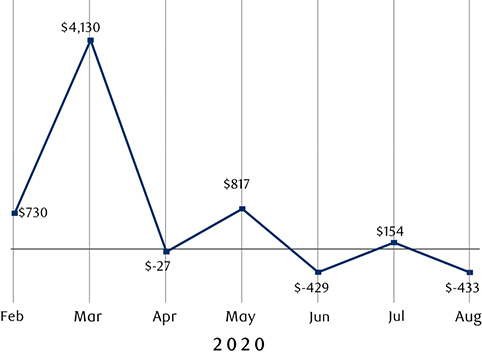

As global markets tumbled in early March, investors flocked to cash, reinforcing the adage that “cash is king” during times of crisis and reflecting the sentiment of Canadian asset and wealth managers. The Investment Funds Institute of Canada (IFIC) reported a significant uptick in mutual fund net sales for money market funds in March 2020 totaling $4.1 billion and an outflow of $18.2 billion from long-term mutual funds.1 Similarly, data research firm Thomson Reuters Lipper reported that, in the seven days prior to March 11, 2020, US money market funds experienced $121 billion of inflows, and Bank of America indicated that investors socked a total of $186 billion into cash during the week of March 8, 2020.2

The IFIC data also shows that net sales of money market funds declined in the months following the emergence of the pandemic, including net redemptions in April, June and August. According to Vivien Lee, Senior Economic Research Analyst at RBC Global Asset Management: “While investors have poured money back into equities and stock markets have roared back to life, there’s still a higher than normal amount sitting on the sidelines in money market funds as of August 2020.”

Canadian Mutual Funds

Money Market Funds | Monthly Net Sales/Redemptions ($ Millions)

Source: Investment Funds Institute of Canada

“ While investors have poured money back into equities and stock markets have roared back to life, there’s still a higher than normal amount sitting on the sidelines in money market funds as of August 2020."

—Vivien Lee, Senior Economic Research Analyst, RBC Global Asset Management

Infrastructure investors and agility

Respondents, particularly large and mid-sized managers, are predicting higher demand for infrastructure assets over the next 12 months. Consistent with this sentiment, a recent survey of leading infrastructure investors across the globe indicated a generally positive view of the ability of the various sectors within this asset class to withstand the impact of COVID-19, ranging from care businesses and global distribution networks to the food infrastructure sector. The transport segment is expected to remain “in the eye of the storm” for the foreseeable future, concern was expressed about whether governments will erect investment barriers, and sustainability is forecast to be front and centre going forward. Investors emphasized the importance of agility—closely monitoring future trends and how to capitalize on them in a timely manner.3

- 1 Investment Funds Institute of Canada, Industry Statistics, July 2020

- 2 Forbes, Cash Is King in the Time of Coronavirus, March 16, 2020

- 3 Infrastructure Investor, How Will COVID-19 Change Infrastructure Investment, June 1, 2020

Digitizing manual processes

#1 technology priority

View Results

Digitization leads the technology priorities

o “Digitizing manual processes” continued to be the top near-term technology investment priority, albeit at a lower level of popularity than last year (23% to 18%),* followed by new categories “improving integration across the firm” (16%) and “data security/cyber resilience” (15%)

o Large firms and “other” managers are also directing their attention to “operational risk management” as a top priority (13% and 14%)

o Respondents in investment roles favoured “portfolio risk management” as their most important technology focus (20%)

Where will your firm focus its technology investments over the next 12 months?**

Fast-tracking change

Accelerating the digital transformation

Consistent with the views of Canadian asset and wealth managers, a recent survey of Chief Financial Officers in the US indicated that 44% of respondents plan to accelerate automation and new ways of working upon transitioning back to on-site working. This includes utilizing technology to help meet social distancing and other safety requirements associated with COVID-19 as the preference for human interaction takes a back seat to reduced personal contact.1

While automation is expected to be a key focus of Canadian managers in the coming months, COVID-19 has already served as a catalyst for digitization initiatives. For example, shortly after the onset of the pandemic, RBC Investor & Treasury Services worked with its clients, including asset and wealth managers, to eliminate manual cheque processing in Canada—an undertaking that stands to provide significant long-term industry benefits. This is just one example of how the pandemic has been instrumental in fast-tracking important changes across the Canadian investment management sector. According to Denys Calvin, Vice-President and Chief Operating Officer at Toronto-based Nexus Investment Management: “We’ve been able to make so many changes, so quickly and so successfully. It makes you wonder why we didn’t do this sooner.”

Achieving inter-operability

Another near-term technology priority is the improvement of integration—and resultant efficiency and oversight—across front, middle and back offices as firms look to re-engineer their traditional ways of doing business. Inter-operability is key. Application Programming Interfaces (APIs), data visualization tools and other technology innovations will provide opportunities to connect and develop more integrated operations. In addition, utilizing technology to protect data and build a cyber-resilient organization will be essential to managing cybercrime, which is projected to cost the global economy approximately $8.0 trillion annually by the end of 2021, double the cost in 2015.2

o $8.0T

Annual cost of cybercrime to the global economy in 2021

“ We’ve been able to make so many changes, so quickly and so successfully. It makes you wonder why we didn’t do this sooner."

—Denys Calvin, Vice-President and Chief Operating Officer, Nexus Investment Management

- * Year-over-year comparisons may be impacted by updates to the wording of this question in 2020 and should be considered directional

- ** Based on respondents’ top three choices

- 1 PriceWaterhouseCoopers, Pulse Survey, June 2020

- 2 Cybersecurity Ventures, 2020 Official Annual Cybercrime Report

Active investments

Most popular investment strategy

View Results

Active Investments are on the rise

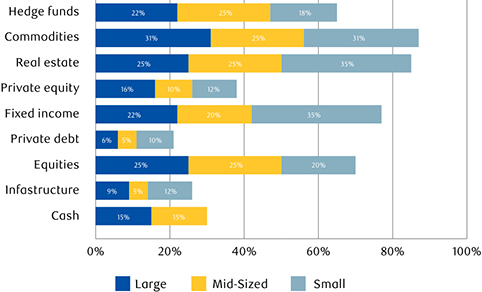

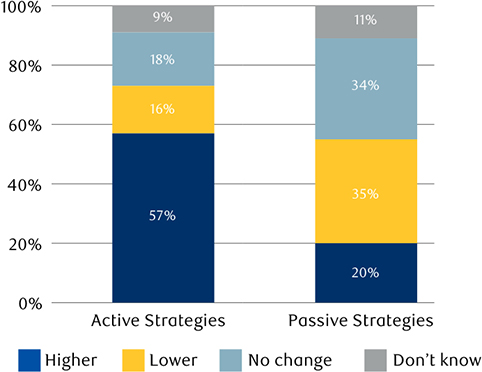

o Overall, 57% of managers anticipate that investor demand for active investment strategies will increase over the next 12 months and only 16% expect a decline

o More than a third (35%) of respondents believe that demand for passive strategies will decline in the near term and only 20% are forecasting higher demand

o The overall trends are generally consistent regardless of respondent size, type or role; however, respondents in investment roles were particularly bullish about active strategies with 70% of respondents anticipating higher demand

How do you expect investor demand to change during the next 12 months?

The shifting cycle

A contrarian view

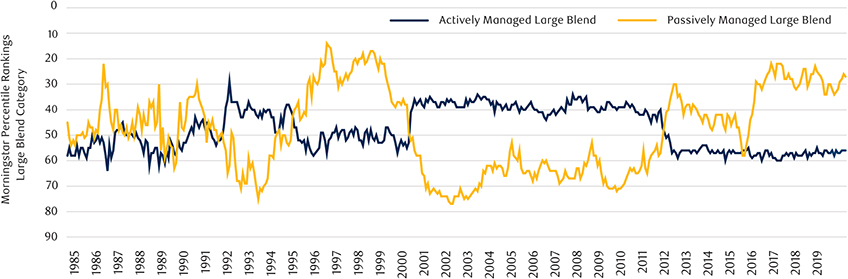

Historically, passive investments have tended to outperform actively managed funds in bull markets, including the period leading up to COVID-19, while active funds have generally outperformed passive funds during recessionary times, including the 2008 financial crisis.1 However, research conducted by the US National Bureau of Economic Research seems to question the validity of this historical trend in the current recessionary environment, showing that almost three-quarters (74%) of active funds underperformed the S&P 500 during the initial stages of COVID-19.2 It will be interesting to look at fund performance over the next 12 months and whether Canadian managers’ anticipated shift to actively managed investments achieves the desired results.

Active and Passive Outperformance Trends are Cyclical

Rolling Monthly Three-Year Periods (1985 to 2019)

Data Sources: Morningstar and Hartford Funds

o 35%

of respondents expect lower demand for passive investments

- 1 Morningstar and Hartford Funds, The Cyclical Nature of Active & Passive Investing, February 2020

- 2 Investment Executive, Active Managers Fumble COVID-19 Opportunity, July 20, 2020

Quality and cost

Top data challenges

View Results

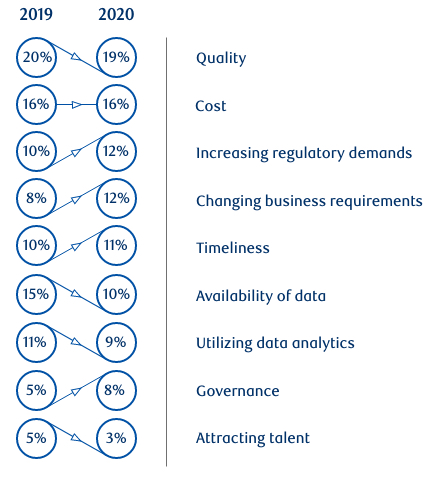

Managing data has fundamental challenges

o Similar to last year, “quality” and “cost” are respondents’ top challenges in managing data (19% and 16%)

o “Availability of data” declined from third to sixth spot (10%), overtaken by “increasing regulatory demands” and “changing business requirements” (tied for third spot at 12%)

o “Availability of data” is a top concern of respondents in the “other” manager category (16%), while “timeliness” is particularly important to respondents in executive roles (16%)

What are the three biggest challenges your firm faces in managing data?

The right data at the right price

Demonstrating ROI

The use of data analytics is increasingly important to managers (see Focus section) as they employ technology to improve connectivity across their firms and with various industry players, a point that is echoed by Francis Jackson, Chief Executive Officer of RBC Investor & Treasury Services: “The industry is becoming highly integrated and inter-operable. APIs and data visualization tools deliver data directly into clients’ own infrastructure, allowing them to monitor their custodians and perform oversight more efficiently.” While the importance of data analytics is rising, managers emphasize that it must be of high quality and available at a reasonable cost to justify the investment.

Protecting data privacy

In addition, increasing regulatory demands moved up the list and is among the top three data management concerns (tied for fifth place last year). Global efforts to introduce more rigorous data privacy protection regimes may be influencing respondent sentiment. Introduction of the European Union’s General Data Protection Regulation (GDPR) in 2018 is serving as the impetus for change. For example, the California Consumer Privacy Act (CCPA) began enforcement on July 1, 2020. In both cases, non-compliance could result in fines or penalties. Quebec has proposed legislation to increase supervision of data usage and, at the federal level, discussions continue on the modernization of Canada’s Privacy Act. Organizations could face challenges in meeting inconsistent rules across the different jurisdictions.

A common theme

Heightened concern about changing business requirements is likely linked to the current disruptive COVID-19 environment. This includes how to utilize the growing volumes of data to make more informed decisions and improve efficiency in these dynamic times —a common theme throughout this report. And where is all the data coming from? As of April 2020, the internet was reaching 4.6 billion people or 59% of the world’s population—a 6% increase from January 2019.1

o 4.6B

Number of people with internet access globally

“ The industry is becoming highly integrated and inter-operable. APIs and data visualization tools deliver data directly into clients’ own infrastructure, allowing them to monitor their custodians and perform oversight more efficiently."

—Francis Jackson, Chief Executive Officer, RBC Investor & Treasury Services

- * Year-over-year comparisons may be impacted by updates to the wording of this question in 2020 and should be considered directional

- 1 Domo, Data Never Sleeps 8.0, August 2020

Working from home

Most lasting legacy of COVID-19

View Results

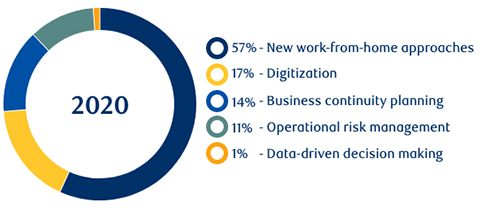

Working from home will endure

o A majority of respondents (57% overall) viewed “new work-from-home approaches” as the most lasting legacy of COVID-19, regardless of manager size, type or role

Which of the following COVID-19 strategies will have the most lasting impact on your firm?*

A likely combination

Morning rush versus isolation

According to Statistics Canada, approximately four out of 10 (39%) Canadian workers are in jobs that can be carried out from home and a similar proportion of workers were teleworking (i.e., working from home) during the last full week of March 2020, compared to just 13% in 2018. This suggests that the Canadian labour market responded very quickly to the onset of COVID-19 by increasing its prevalence of telework to the maximum capacity.1

It appears unlikely that on-site working will revert to pre-pandemic levels anytime soon. Many employees will be loath to return to the morning rush. A recent survey of white-collar US workers found that, once employees adjusted to the initial change of working from home, satisfaction increased, stress levels fell and productivity increased.2 In addition, a survey of Canadians found that nearly a quarter plan to work from home more often a year down the road, while 40% didn’t know or were unsure.3 Despite the apparent trend towards working from home, could the sentiment change as employees begin to miss the camaraderie of colleagues and develop feelings of isolation?

Real estate savings versus higher employee and cyber costs

Employers may be attracted to potential COVID-related real estate savings, which are unlikely to have an immediate impact on the bottom line with the typical corporate lease lasting at least five years.4 Notwithstanding these possible longer term savings, organizations will incur additional costs to ensure worker safety at the office. It could also prove costlier to provide virtual training and performance oversight at home, not to mention the increased cybersecurity risks. And what if the initial productivity gains prove to be unsustainable?

o 39%

of Canadian workers were teleworking at the end of March 2020

Reviving the economy

Regardless, offices will ultimately begin to re-open as governments look to gradually get employees back to the workplace where they will help drive economic recovery. The Canada Pension Plan Investment Board agrees: “We expect a long-term uptick in remote work, though more in the form of flexible schedules that allow for a few days per week at home, rather than a wholesale abandonment of the office.”5

- * Based on respondents' top choice

- 1 Statistics Canada, Running the Economy Remotely, May 28, 2020

- 2 Harvard Business Review, The Implications of Working Without an Office, July 15, 2020

- 3 Dalhousie University, COVID-19 Telecommuting, July 2020

- 4 The Economist, Office Politics, September 12, 2020

- 5 Canada Pension Plan Investment Board, How COVID-19 is Shaping the Landscape for Long-Term Investors, August 19, 2020

About the survey respondents

Type

Location

Size (by assets under management)

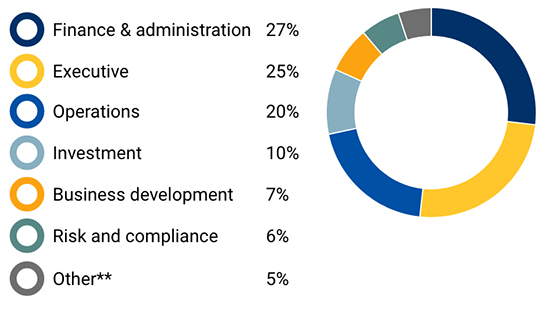

Role

- * Including in-house and third-party managers

- ** Including relationship management and technology

About RBC Investor & Treasury Services

RBC Investor & Treasury Services is a specialist provider of asset services, custody, payments and treasury services for financial and other institutional investors worldwide, with over 4,500 employees in 16 countries across North America, Europe and Asia. We deliver services to safeguard client assets, underpinned by client-centric digital solutions that continue to be enhanced and evolved in line with our clients’ changing needs. Trusted with $4.5 trillion in client assets under administration,(1) RBC Investor & Treasury Services is a financially strong partner with among the highest credit ratings globally.(2)

- 1 Royal Bank of Canada quarterly results released July 31, 2020

- 2 Standard & Poor’s (AA-) and Moody’s (Aa2) legacy senior long-term debt ratings of Royal Bank of Canada as of August 25, 2020

CONTACT US

David J. Giannone

Global Head of Business Development

david.giannone@rbc.com

Throughout this report, currencies are in Canadian dollars and percentages show proportion of choices unless otherwise indicated

© Copyright Royal Bank of Canada 2020. RBC Investor & Treasury Services™ is a global brand name and is part of Royal Bank of Canada. RBC Investor & Treasury Services operates primarily through the following companies: Royal Bank of Canada, RBC Investor Services Trust and RBC Investor Services Bank S.A., and their branches and affiliates. This document is provided for general information only and does not constitute financial, tax, legal or accounting advice, and should not be relied upon in that regard. RBC Investor & Treasury Services makes no representation or warranty of any kind regarding the accuracy or completeness of any information contained or referred to in this document. To the full extent permitted by law, neither RBC Investor & Treasury Services nor any of its affiliates or any other person accepts any liability whatsoever for any direct, indirect or consequential loss or damage arising from any use of the information contained herein by the recipient or any third party. Links to external websites are for convenience only. RBC Investor & Treasury Services does not review, endorse, approve, control or accept any responsibility for the content of those sites. Linking to external websites is at your own risk. ® / ™ Trademarks of Royal Bank of Canada. Used under licence.