Canada’s securities and insurance regulators have proposed new rules requiring enhanced disclosure of investor costs for Canadian investment funds and segregated funds. The Total Cost Reporting (TCR) initiative is designed to help ensure investors understand the cost of advice, and can assess and compare the performance of their investments.

Reena Hunjan, Associate Director of Regulatory Solutions at RBC Investor & Treasury Services, outlines the path that has led to the planned changes, and their potential impact on asset managers and investor behaviour.

Building on regulatory momentum

The proposed TCR rules are “part of a global initiative to increase transparency for investors and help them make better decisions," comments Hunjan. The move towards increased disclosure for funds and insurance products in Canada “is consistent with trends we've seen globally—across Europe and the UK, and in the United States and Singapore," she adds.

The TCR initiative is the third wave of increased disclosure requirements

The TCR initiative is the third wave of increased disclosure requirements in Canada, beginning with the Client Relationship Model (CRM) in 2009 and the Client Relationship Model 2 (CRM2) requirements, which were implemented by mid-2017. CRM harmonized registration requirements across the Canadian securities industry, while CRM2 provided investors with details of account fees and the performance of their investment accounts.

The new TCR requirements were published for comment in April 2022 after a multi-stakeholder development process; comments closed on July 27, 2022.

Filling information gaps

Following implementation of CRM2, Hunjan notes, various studies found that few investors were able to identify their total cost of investing or the type of costs included in their fee summaries. “CRM2’s focus on the amount paid for the ‘advice’ component of investing may have led some investors to believe that their total fees were less than what they actually paid.”

According to Hunjan, TCR builds on the disclosure requirements established by CRM2, expanding the investment cost information provided to clients and “filling some of the potential information gaps that remain after implementation of CRM2 reporting for clients."

For example, the CRM2 initiative excluded the Management Expense Ratio (MER), one of the main costs an investor pays, and did not consider the Trading Expense Ratio (TER), which identifies the cost of trades executed by the fund manager.

TCR builds on the disclosure requirements established by CRM2, expanding the investment cost information provided to clients

“TCR is intended to provide a more comprehensive view of investor costs" than is available through CRM2, comments Hunjan. The intent of the new regulation, she says, “is to ensure that investors have cost and fee information in front of them so they are better able to evaluate personal investing decisions, and assess their ability to meet financial and investment goals."

Applying to the fund and insurance sectors

TCR’s proposed securities amendments would apply to all registered dealers, advisors and investment fund managers, and the new insurance guidelines would apply to all insurers offering segregated fund contracts to their policy holders:

- For investment funds, the proposal will require client account statements to include information on the aggregate of the MER and TER as a percentage called the “fund expense ratio" for each investment fund held by the client at the end of the statement period. Managers would also be required to provide an annual cost and performance report that includes a client's aggregate fund expenses during the year, along with the total dollar amount of any direct investment fund charges such as redemption fees or short-term trading costs.

- In the insurance sector, insurers would be required to provide a new report to clients at least annually identifying the fund expense ratio for each fund held by the client, the aggregate amount of fund expenses, the cost of insurance guarantees, and the cost of all other expenses during the statement period.

Preparing for the new rules

Based on existing timelines, the TCR requirements are expected to come into force in Q4 2024 for securities and in June 2025 for the insurance sector. Hunjan says, “It is essential for managers to carefully review the TCR requirements well in advance of the effective dates to ensure they are ready for the new rules.”

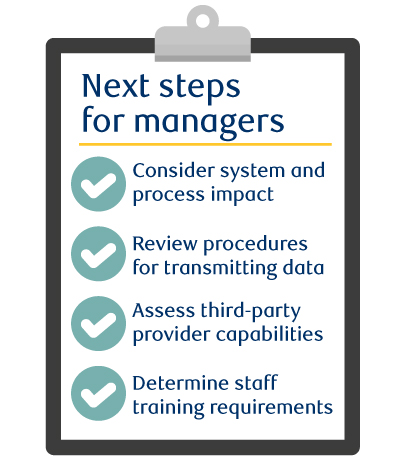

She suggests the following steps for managers to prepare for the changes:

- Assess current systems, processes and procedures to identify any gaps in calculating the additional data required

- Implement processes for disseminating MER and TER information to dealers or advisors if necessary

- Review monitoring processes for any external service providers contributing to the capture, computation or reporting of required data

- Develop training programs for staff regarding the new requirements as required

The new TCR regulation is all about transparency for investors and providing them with cost information

The new TCR regulation, part of a global disclosure trend, is all about transparency for investors and providing them with cost information to make informed investment decisions. While the regulation may be refined based on the recent comment process, Hunjan urges managers to become familiar with the proposed changes now and start thinking about what is required to comply with these changes. She concludes: “The implementation timelines may seem far off at the moment, but they’ll be upon us before we know it.”