With a flexible modular approach to delivering meaningful insight, our middle office solutions are designed around your strategic, financial, tactical and administrative needs and can help:

Adapt

to the evolving technological environment

Transform

operational and financial performance

Mitigate

financial, operational and reputational risk

Our Middle Office Modules

Supporting a wide range of investment strategies, our middle office solutions1 are custodian agnostic and leverage comprehensive data visualization tools to provide you with the oversight and control you need.

Collateral Management

Leveraging industry-leading technology provided by CloudMargin via IHS Markit, our Collateral Management module combines RBC Investor Services' asset servicing expertise with award-winning2 innovative software to create a powerful solution for our asset manager clients.

Trade Management

Offering an end-to-end post trade execution service to support you through every stage of the investment lifecycle.

Corporate Actions Management

Simplifying multiple custodian relationships and driving efficiencies, our Corporate Actions Management module enables making elections seamless across all of your portfolios.

Investment Book of Record (IBOR)

IBOR delivers near-real-time investment insight of your positions and investible cash which can improve your investment decision making process.

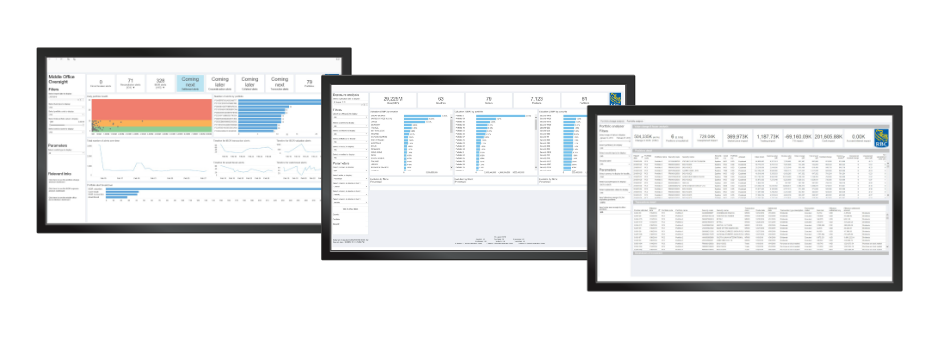

Delivered Through Data Visualisation

As your middle office data partner, we can deliver the meaningful insight you need in the format you choose. Through customizable dashboards and detailed views of accounts, we'll provide on demand access to management information including data exceptions/outliers, trends across significant data sets, drill-downs and data exploration capabilities.

RBC One Data Visualisation Tools

The Middle Office oversight tool allows users to customise reporting options to deliver the data that is important, providing an exception based view of controls and a clear audit trail to support regulatory oversight obligations.

Our Credentials 3

Our Credentials

15+

years experience

30+

custodian connections

97.79%

trades matched on T

600+

broker connections

- Products and services may not be available in all jurisdictions.

- List of awards available at https://cloudmargin.com/category/press-release/

- Based on internal records